Having concluded a loan agreement, did you realize that the document was signed on unequal terms? What is the right thing to do in such a situation and in what cases is it possible to cancel the transaction? You will learn about this in this article.

In what cases is it possible to recognize a loan agreement as invalid?

Only a court can annul the contract. The judge makes a decision based on consideration of all aspects of the case, state regulations, which are provided for in Art. 166-181 of the Civil Code of the Russian Federation. These include the following situations:

- If the agreement with the bank was concluded as a result of the client's delusion. That is, loan officers did not fully disclose the whole essence of the agreement or deliberately concealed some important points of the transaction. Then, on the basis of Russian law, it can be considered that the client was misled and the contract may be challenged.

- If any of the terms of the debt agreement is contrary to human rights and the Constitution.

- If the deal was made with a person who is incapacitated.

- If a person is pushed to sign a contract by force or with the help of threats and pressure.

- If the money was received by the borrower not in full or not at all issued. In this case, the transaction can be challenged on the basis of its lack of money under Article 812 of the Civil Code of the Russian Federation.

Contested transactions or consequences of violations of the loan agreement

A loan is a two-way deal. Russian legislation establishes norms not only for individuals who conclude an agreement. Requirements are formally presented to the content, form of the document and the goals of the parties when applying for a loan. In cases of violations of the law, the transaction can be challenged in arbitration or civil litigation. Often, non-compliance with the rules when concluding a contract has certain consequences. These contracts include:

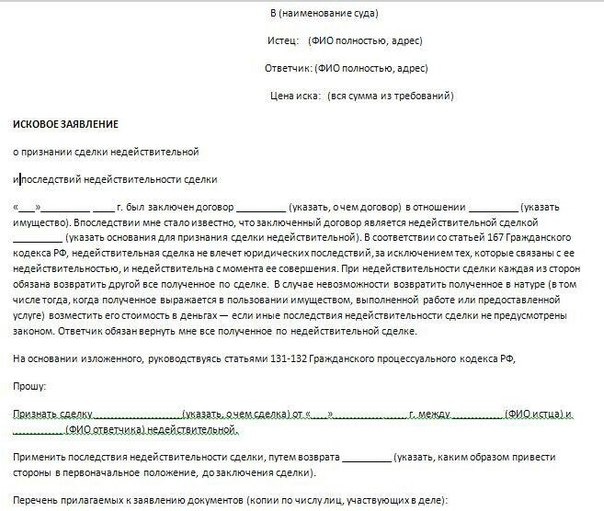

In order to dispute a loan transaction, you need to write and file a claim with the bank in court. In it you must indicate:

- your passport data (registration address, actual residence address, passport series and number, by whom and when the document was issued);

- an identification number;

- your contact phone number;

- bank coordinates (TIN, Central Bank license number, legal address);

- contact details of all individuals who have anything to do with a dispute with the bank;

- the whole essence of the dispute that has arisen;

- your requirements to the court;

- signature and date.

Change of the loan agreement: on what conditions is it possible

Both the borrower and the lender can change the terms of the credit transaction. The new conditions must not contradict the law and human rights. Changes to the contract are made by mutual agreement of the parties. So, it is possible to change the terms of the loan agreement in such cases:

- As practice shows, not all borrowers carefully study each clause of the agreement. Often, changes in the contractual terms from the creditor are unexpected for the debtor. In such cases, it is important to understand that the bank is obliged to warn you and inform you in detail about all changes in the clauses of the debt contract. If this does not happen, you can demand compensation for moral damage and the revision of the terms of the loan agreement in a lawsuit.

- In order to avoid the accrual of penalties and commissions, always try to repay the loan on time and keep the originals of all payment receipts with you.

- Thoroughly study your rights and obligations under the agreement with the bank.

- Remember that you are the person responsible for meeting or failing to comply with the terms and conditions of your loan. Its violation entails the corresponding consequences (fines, legal proceedings, etc.).